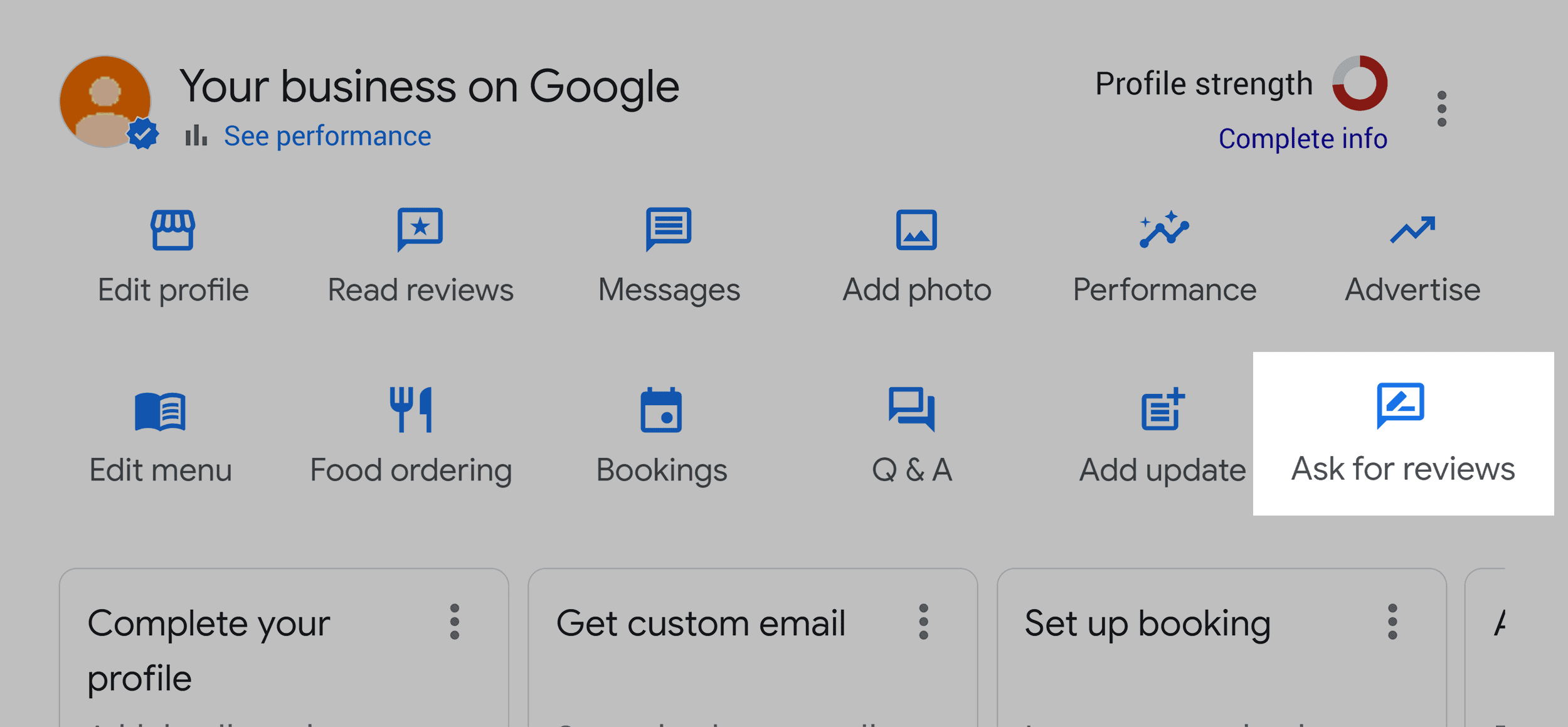

Transforming Your Technique to GBP Management

In the realm of global financial markets, taking care of the British Extra pound (GBP) needs a careful and tactical approach that goes past traditional techniques. As the dynamics of the GBP market proceed to progress, experts are tasked with reevaluating their monitoring methods to stay in advance of the contour.

Comprehending GBP Market Dynamics

The understanding of GBP market dynamics is crucial for making educated decisions in international exchange trading. The GBP, additionally understood as the British Extra pound, is one of the most traded currencies in the globe.

Economic signs play a significant function in shaping the GBP's performance. Trick elements to check include GDP development, inflation rates, joblessness figures, and rate of interest decisions by the Financial institution of England. Favorable economic information typically enhances the extra pound, while negative data can bring about depreciation.

Geopolitical events can likewise influence the GBP's value. Brexit, for instance, has actually been a significant chauffeur of volatility in the last few years (linkdaddy GBP management). Adjustments in government policies, trade arrangements, and worldwide occasions can all affect market view and the GBP's direction

Executing Danger Administration Approaches

Leveraging Modern Technology for GBP Evaluation

Utilizing advanced technological tools boosts the accuracy and performance of examining GBP market fads and characteristics. AI formulas can determine patterns and connections in the GBP market, offering important insights for decision-making.

Furthermore, information visualization devices play a critical duty in streamlining complicated data sets right into conveniently digestible graphs and charts. These devices allow analysts to spot opportunities, abnormalities, and fads swiftly. Device learning formulas can be trained to forecast GBP market movements based on historic data, aiding to direct strategic decisions.

Diversifying GBP Financial Investment Portfolios

With my blog a strong foundation in leveraging innovation for GBP analysis, monetary professionals can now purposefully branch out GBP financial investment portfolios to maximize returns and reduce threats. Diversification is an essential concept that includes spreading out investments throughout different possession courses, industries, and geographical areas. By branching out a GBP profile, investors can decrease the influence of volatility in any single property or market sector, potentially boosting overall performance.

One efficient means to diversify a GBP investment profile is by allocating assets across various types of securities such as equities, bonds, property, and assets. This approach can assist balance the profile's risk-return account, as various property classes have a tendency to behave in different ways under numerous market conditions.

Surveillance GBP Efficiency Metrics

To effectively assess the efficiency of a GBP investment right here portfolio, financial specialists need to focus on key efficiency metrics that supply insights into its productivity and danger management. Monitoring GBP efficiency metrics is important for making informed choices and enhancing portfolio end results.

Volatility metrics such as common discrepancy and beta are also vital signs of risk. Typical variance measures the diffusion of returns, highlighting the portfolio's security or variability, while beta analyzes its sensitivity to market movements. Comprehending these metrics can aid in taking care of risk direct exposure and adjusting the profile's allotment to fulfill desired threat levels.

Additionally, tracking metrics like Sharpe proportion, details proportion, and drawdown analysis can provide deeper insights into risk-adjusted returns and drawback security. By methodically checking these efficiency metrics, economic specialists can fine-tune GBP investment techniques, enhance performance, and far better browse market variations.

Verdict

Finally, revolutionizing the approach to GBP management involves understanding market dynamics, implementing risk monitoring approaches, leveraging modern technology for evaluation, branching out investment portfolios, and keeping track of performance metrics. By including these vital components right into your GBP administration technique, you can optimize your decision-making procedure and attain higher success in navigating the intricacies of the GBP market.

With a solid structure in leveraging technology for GBP evaluation, financial experts can now tactically diversify GBP investment profiles to enhance returns and minimize risks.

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now!